Form E Borang E is required to be submitted by every employer companyenterprisepartnership to LHDN Inland Revenue Board IRB every year not later than 31 March. Commission fees statement prepared by company to agents dealers distributors.

Fill Other Free Fillable Pdf Forms

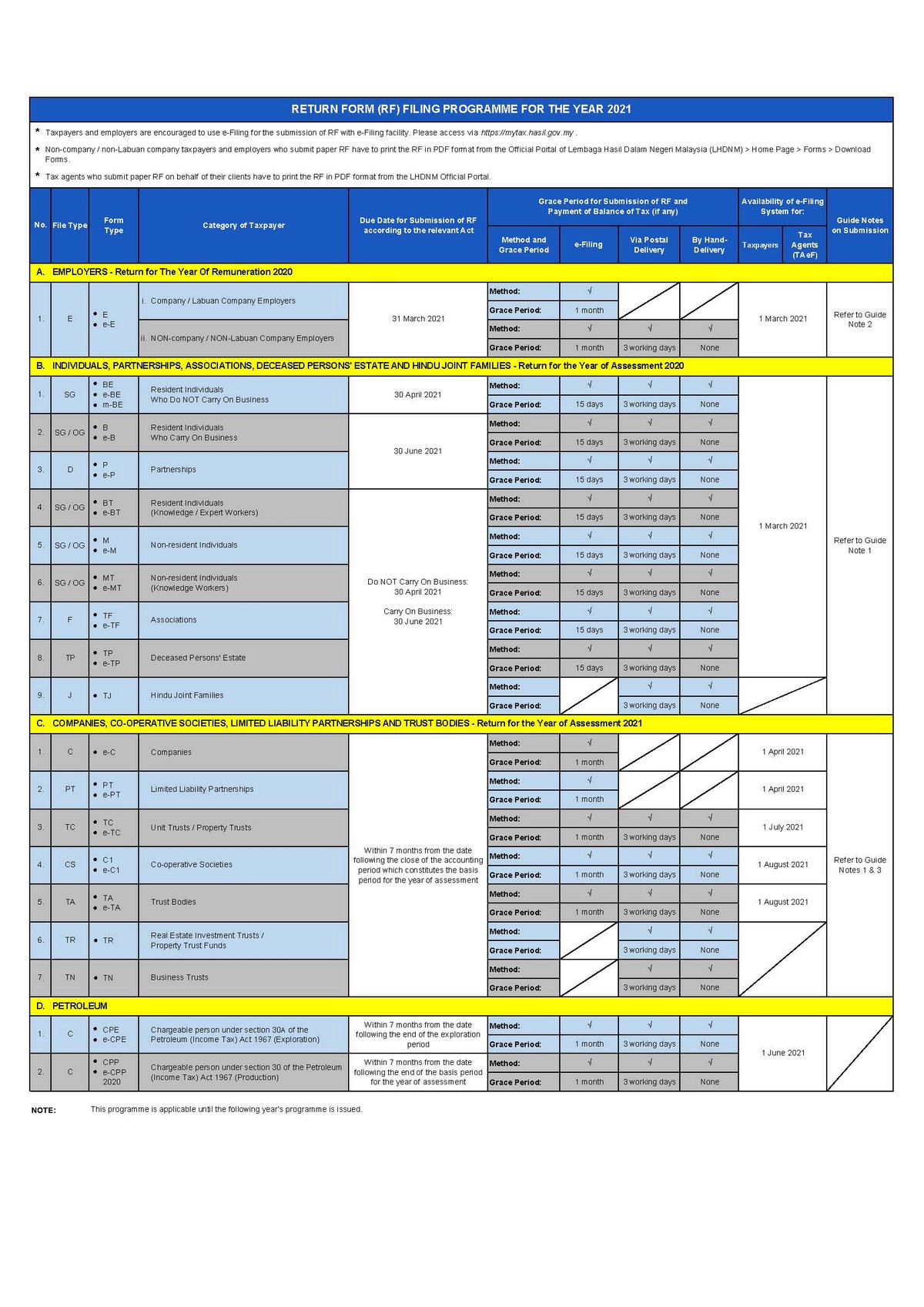

The deadline for business tax returns is June 30.

. According to the Income Tax Act 1967 Akta 53. Available in Malay Language only. The deadline for submitting BT M MT TP TF and TJ forms non-merchants is April 30.

3 322 Badan amanah koperasi dan PLT diwajibkan untuk mengemukakan Borang CP204 dan Borang CP204A secara e-Filing mulai. Mulai Tahun Taksiran 2018 anggaran cukai perlu dihantar secara e-Filing e-CP204. Tambahan masa diberikan sehingga 15 Mei 2022 bagi e-Filing Borang BE Borang e-BE Tahun Taksiran 2021.

Bagi borang E tarikh tutup penghantaran borang secara online menerusi e-Filling adalah pada 31 Mac 2017. Select E-filing e-Borang e-E The Borang E for the year will only be. Pengesahan ini boleh didapati melalui perkhidmatan ezHASiL di httpsezhasilgovmy atau di cawangan-cawangan LHDNM.

The following information are required to fill up the Borang E. The deadline for Form B and P is June 30. HASiL BERSAMA MEMBANGUN NEGARA 2.

Penyata Oleh Majikan bagi majikan bukan Syarikat 31 Mac 2022 Tambahan masa 1 bulan untuk e-Filing BE. E-Filing e-CP204 atau borang kertas CP204 ke Pusat Pemprosesan Maklumat LHDNM secara manual. Tarikh akhir pengemukaan Borang BE Tahun Taksiran 2021 adalah 30 April 2022.

On or before 15th June 15 of advance tax On or before 15th September 45 of advance tax On or before 15th December 75 of advance tax On or before 15th March 100 of advance tax Income Tax Return. Lembaga Hasil Dalam Negeri Malaysia Special Industry Branch Tingkat 11-13 Blok 8 Kompleks Bangunan Kerajaan Jalan Tuanku Abdul Halim 50600 Kuala Lumpur. EMPLOYERS RETURN FORM Borang E Submit Employers Return Forms Borang E example E-2018 by 31st March every year even you dont have any employees starting from the following year of LLP registration.

Any dormant or non-performing company must also file LHDN E-Filing. E 2021 Explanatory Notes and EA EC Guide Notes. This form can be downloaded and submitted to.

Hantar Borang e-C secara e-Filing. According to LHDN LLP PLT can fill out the Borang E online Login to ezhasilgovmy. Annual income statement prepared by company to employees for tax submission purpose.

Tarikh tutup hantar borang cukai e-Filing 2017 LHDN terkini secara online. Bayaran Ansuran Syarikat anggaran dibuat oleh syarikat. Ada Punca Pendapatan PerniagaanPekerja Berpengetahuan atau Berkepakaran.

English Version CP8D CP8D-Pin2021 Format. 8D KAEDAH PENGEMUKAAN OLEH MAJIKAN BAGI TAHUN SARAAN 2016 CP. Procedures For Submission Of Real Porperty Gains Tax Form.

BNCP dan borang anggaran yang disediakan dalam e-Filing adalah seperti berikut. Grace period is given until 15 May 2018 for the e-Filing of Form BE Form e-BE for Year of Assessment 2017. 1 Tarikh akhir pengemukaan borang.

Dimaklumkan bahawa pembayar cukai yang pertama kali. B Kegagalan mengemukakan Borang E pada atau sebelum 31 Mac 2019 adalah menjadi satu kesalahan di bawah. Borang E 2021 PDF Reference Only.

Check out E-Newsletter February 2018 from 3E Accounting Services Sdn. Income tax return for partnerships. Due date to furnish Form E for the Year of Remuneration 2018 is 31 March 2019.

Jika anda belum pernah mengisi borang cukai pendapatan kami ada panduan mudah berikut. Failure to submit the Form E on or before 31 March 2019 is a criminal offense and can be prosecuted in court. The deadline for submitting Form E is March 31.

If a taxpayer furnished his Form e-BE for Year of Assessment 2017 on 16 May 2018 the receipt of his ITRF shall be considered late as. Form e-E All companies must file Borang E regardless of whether they have employees or not. Borang Nyata Individu Pemastautin yang tidak menjalankan perniagaan 30 April 2022 Tambahan masa 15 hari untuk e-Filing B.

Subscribe to Our Mailing List to Get Latest E-Newsletter Updates. 31 Mac 2019 a Borang E hanya akan dianggap lengkap jika CP8D dikemukakan pada atau sebelum 31 Mac 2019. Jika pembayar cukai mengemukakan Borang e-BE Tahun Taksiran 2021 pada 16 Mei 2022 BN tersebut akan dianggap sebagai lewat diterima mulai 1 Mei 2022 dan.

8D FORMAT METHOD OF SUBMISSION BY EMPLOYERS FOR THE YEAR OF REMUNERATION 2016 Majikan dikehendaki mengemukakan format CP. Internet Explorer 110 Microsoft Edge Mozilla Firefox 440 Google Chrome 460 atau Safari 5. Issued to inform you.

The deadline for BE is April 30. Tarikh Akhir MENGHANTAR Borang dan MEMBAYAR cukai pendapatan tahun taksiran 2021. 1 Due date to furnish this form31 March 2019.

Majikan yang aklumat melalui e-Data Praisi tidak perlu mengemukakan Borang CP8D. Form CP251 NEW FORMS CP250 CP 251 WILL TAKE EFFECT FROM JUNE 2018. Musim cukai sudah bermula sejak 1 Mac lalu dan tarikh akhir untuk anda menyerahkan borang cukai pendapatan untuk tahun taksiran 2018 ialah pada 31 April bagi borang BE dan 30 Jun untuk Borang B.

April 30 for electronic filing ie. 8D kepada LHDNM melalui salah satu kaedah yang dinyatakan berikut. Borang E is an Employers annual Return of Remuneration for every calendar year and due for submission by 31st March of the following calendar year.

Employers with their own computerised system and many employees are encouraged to prepare CP8D data in the form of txt as per format stated in Part A. The due date for submission of Form BE for Year of Assessment 2017 is 30 April 2018. Aplikasi e-Filing adalah merupakan sistem yang membolehkan pembayar cukai membuat pengisian dan menghantar Borang Nyata Cukai Pendapatan BNCP dan borang anggaran secara dalam talian.

Form used by company to declare employees status and their salary details to LHDN. Microsoft Windows 81 service pack terkini Linux atau Macintosh. Should there be no written agreement the disposal date may be defined as the date of the final payment made.

RETURN OF REMUNERATION FROM EMPLOYMENT CLAIM FOR DEDUCTION AND. 32 Pengemukaan Borang CP204 dan Borang CP204A secara e-Filing di bawah subseksyen 107C7A ACP 321 Syarikat diwajibkan untuk mengemukakan Borang CP204 dan Borang CP204A secara e-Filing mulai Tahun Taksiran 2018.

My Lhdn Cp600f 2018 2022 Fill And Sign Printable Template Online Us Legal Forms

Lhdn Officially Announced The Deadline For Filing Income Tax In 2021 Attached Is A Guide To Tax Filing Online Everydayonsales Com News

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Tpc Pea Registration Submission Estate Agent S Examination Part 1 2

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

Fill Other Free Fillable Pdf Forms

Amazon Com Custom Printed 4 25 X 7 Inches Carbonless Non Profit Charitable Donation Receipt Books Ncr 2 Part Staple Bound Pads With Manila Cover Personalized With Your Company Name And Number 300 Qty Office Products

Form E 2018 What You Need To Know Kk Ho Co

What Is Cp22 Cp22a Where To Download Cp22 Cp22a Sql Payroll

Malaysia Tax Guide What Is And How To Submit Borang E Form E

Lhdn Officially Announced The Deadline For Filing Income Tax In 2021 Attached Is A Guide To Tax Filing Online Everydayonsales Com News

Max Co Chartered Accountants Posts Facebook

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

Tpc Pea Registration Submission Justletak Main Site

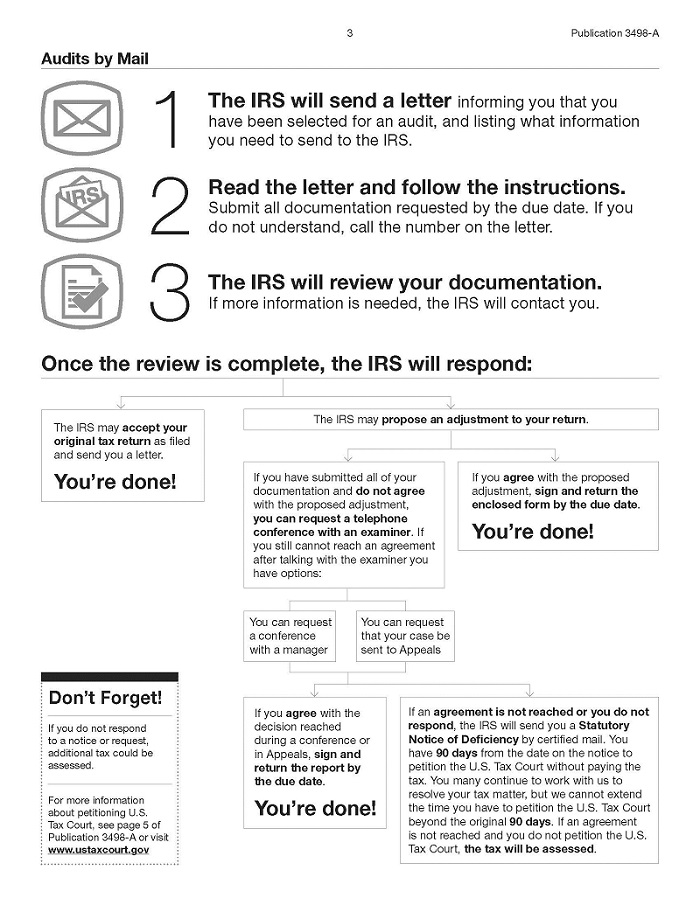

Audits By Mail Taxpayer Advocate Service

Lhdn Officially Announced The Deadline For Filing Income Tax In 2021 Attached Is A Guide To Tax Filing Online Everydayonsales Com News

.png)

What Is Form Cp58 And Do You Need To Prepare It

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Tpc Pea Registration Submission Estate Agent S Examination Part 1 2